20 February 2022

Courtesy of CSIL Centre for Industrial Studies – Milan, Italy

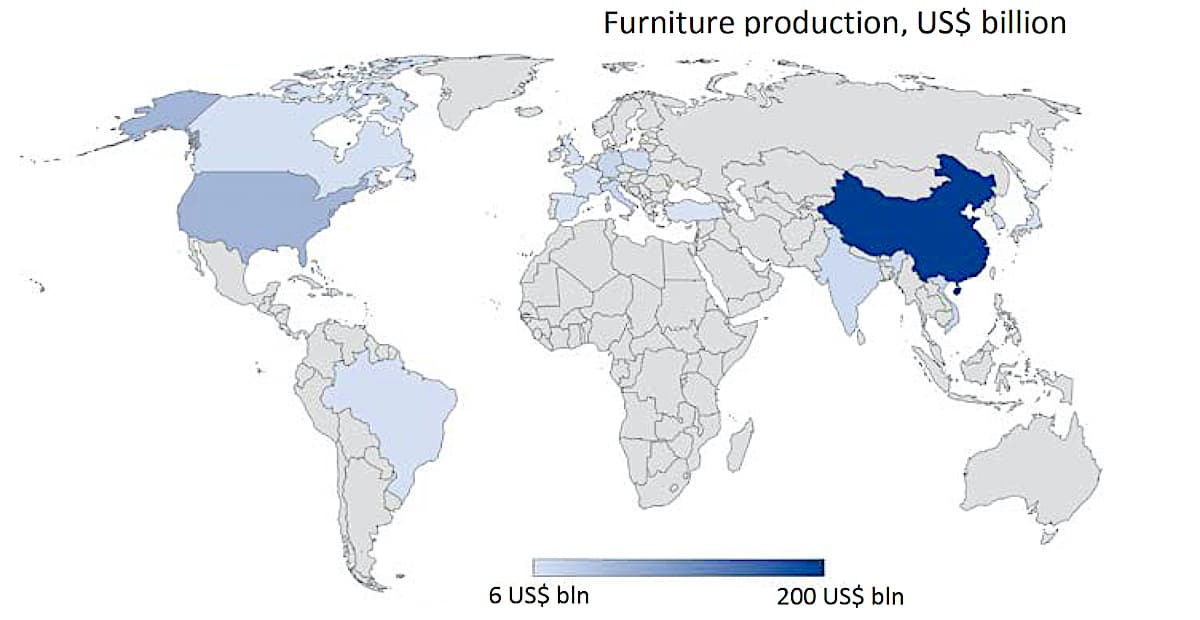

According to CSIL’s World Furniture Outlook 2022, world production of furniture in 2021 will exceed US$ 500 billion; a stronger‐than‐expected recovery, mainly due to the major contribution from Europe and Asia. China is the world’s largest producer, exporter, and consumer of furniture.

Demand was globally strong with differences across countries and segments. However, production growth is subject to a series of constraints: raw material scarcity and growing prices, supply chain challenges, high costs of transport and container shortages. Moreover, systemic uncertainties, deriving from continuing trade restrictions and changing supply chain strategies, affect the entire furniture sector.More than half of world furniture production took place in Asia and the Pacific. The main furniture producer is China, followed at a distance by the US, Germany, and Italy.

According to CSIL estimates, the value of production in China reaches US$ 200 billion.

In the last ten years international trade of furniture has grown faster than furniture production, and has consistently amounted to about 1% of international trade of manufactures, reaching about US$ 152 billion in 2018 and 2019. The pandemic has caused stagnation in 2020 but 2021 is a year of steep growth. Prospects for 2022 and 2023 are favorable, with uncertainties deriving from supply constraints and transport problems. The bulk of international trade of furniture originates in China, Vietnam, Poland, Germany and Italy, and goes to the US, Germany, France, the UK, and the Netherlands (a trading hub).

China exports furniture to the world for a total of US$ 77 billion.

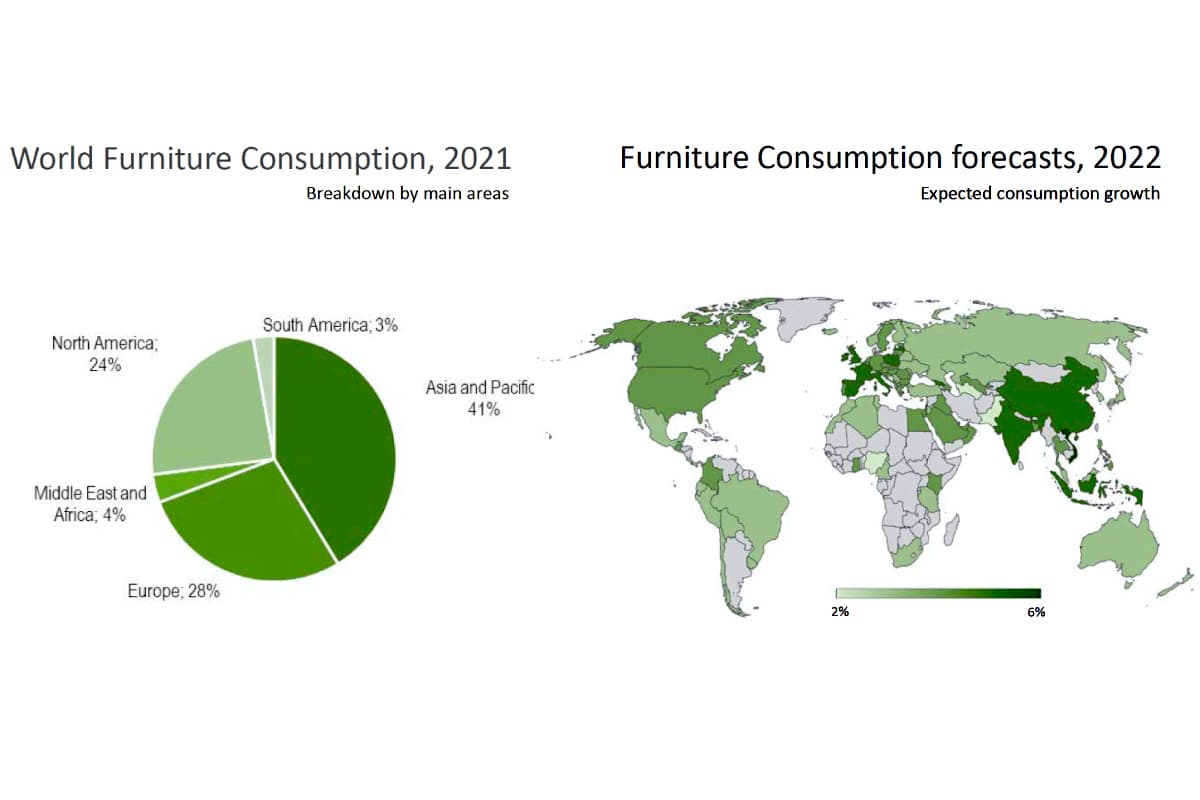

On the consumption side, the lockdown experience highlighted the importance of home which acquired a new centrality both for living and working. Spending more time at home pointed out the usefulness of having functional spaces for the whole family, possibly modular furniture also suitable for working from home. Consumers invested in improving their living spaces, often allocating to furniture substantial portions of income made available because of decreased expenditure for other leisure activities. For this reason, the worldwide pandemic‐induced contraction in furniture consumption in 2020 was limited in size, affecting the different products of the furniture aggregate in different ways. Office furniture was more severely hit, following the decline in investments by both the industry and the service sector. Strong growth has resumed in 2021, with furniture consumption reaching a level well above the pre‐pandemic values.

The domestic furniture consumption in China reaches a value of US$ 125 billion. According to IMF World Economic Outlook (October 2021), World GDP growth is resuming in 2021 (5.9%), in 2022 (4.9%) and 2023 (3.6%). Growth prospects remain stronger for emerging and developing economies than for advanced economies. Uncertainties remain high, differences in the speed of recovery (both across and within countries) will be substantial and downside risks remain significant.

According to IMF World Economic Outlook (October 2021), World GDP growth is resuming in 2021 (5.9%), in 2022 (4.9%) and 2023 (3.6%). Growth prospects remain stronger for emerging and developing economies than for advanced economies. Uncertainties remain high, differences in the speed of recovery (both across and within countries) will be substantial and downside risks remain significant.

For the world as a whole (100 countries) furniture consumption growth is forecasted at about 4% in 2022 (in real terms). Among large markets (over US$ 5 billion of furniture consumption) the countries expected to have a greater rebound in furniture consumption growth are European and Asian countries.

Data and diagram: CSIL